# Trump Declares: U.S. No Longer Needs Canada’s Resources

A recent, and potentially destabilizing, announcement by President Trump is poised to reshape North American trade dynamics. Trump boldly stated that the United States no longer requires Canadian oil, gas, vehicles, or lumber imports. This proclamation has sent shockwaves through many industries, including construction and real estate development.

Understanding the Implications

These four resources occupy an essential part of the U.S-Canada trade relationship. In terms of construction and real estate developments, let’s zero in on Canadian lumber. This product has been at the heart of many trade disputes between the two nations, especially as the U.S. construction industry heavily relies on softwood lumber imports from Canada.

Suffice to say, Trump’s statement raises several potentially disruptive questions: How will it impact the cost of construction materials? What would be the knock-on effect on real estate prices? How about the viability of ongoing and planned construction projects?

Will U.S. Real Estate Feel the Pinch?

Severing ties with Canadian resource imports could lead to increased construction costs. Naturally, this would impact the prices of commercial and residential properties. Is America ready to bear the increase in overhead costs?

Moreover, the prospect of limited resource availability could slow down ongoing construction projects and perhaps discourage the initiation of new ones. This will inevitably have repercussions on the employment rate and overall performance of the construction sector, which has historically been an important floatilla for the U.S. economy.

The Repercussions for Canada

It’s not just the U.S that will feel the impact. Canada, historically reliant on the U.S. as a major market for its exports, might face economic repercussions as well. The reduced demand could lead to job losses across the related industries, a slowdown in production, and potential shortfalls in revenue.

A critical fallout could be the devaluation of Canada’s natural resources. As the biggest oil reserve holder after Saudi Arabia and Venezuela, a potential decline in the demand for its oil and gas could devalue Canada’s extensive petroleum reserves. Similarly, a lack of demand for Canadian lumber exports could cause the same predicament for the timber industry.

Local Solutions for Global Problems

It is at times like this that construction and real estate industries must tap into innovative strategies to mitigate risk. Businesses can safeguard their interests by exploring more local sources of materials and building partnerships that promote sustainable practices.

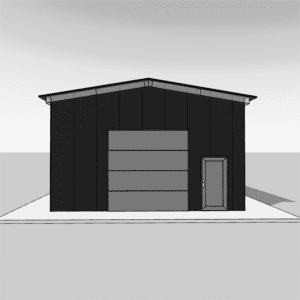

Are you a business based in Alberta, struggling to find local alternatives to Canadian steel? Have you considered selecting local suppliers of steel buildings in Alberta, for instance? They provide high-quality steel buildings that last, all while supporting the local economy and reducing shipping and import costs.

Similarly, if you’re based in Ontario, linking up with local steel building providers in Ontario could provide a more sustainable alternative without skimping on quality or reliability.

Looking Ahead

Uncertainty looms large as the world watches with bated breath to see how the new U.S. trade policy unfolds and its cascading effects on the construction and real estate development industries. Some things, however, are certain – the situation necessitates a swift adaptation of strategies and a robust, forward-thinking approach to deal with the impending changes.

Intrigued, have thoughts to share, or queries related to the topic? Leave your comments below and join the conversation about how this paradigm shift might affect the construction and real estate landscape. Remember, knowing, planning, and action are always the best forms of defense.

This report was originally sourced from CBC News.